Tesla’s Stock Declines: $700 Billion Loss Since Trump’s Election

Tesla’s stock has plummeted, losing $700 billion in value since the 2016 election. As shares drop due to declining sales and competitive pressures, there is growing investor concern over Musk’s political engagement. The company’s high valuation raises further questions about its future performance, amid potential for a short-term recovery.

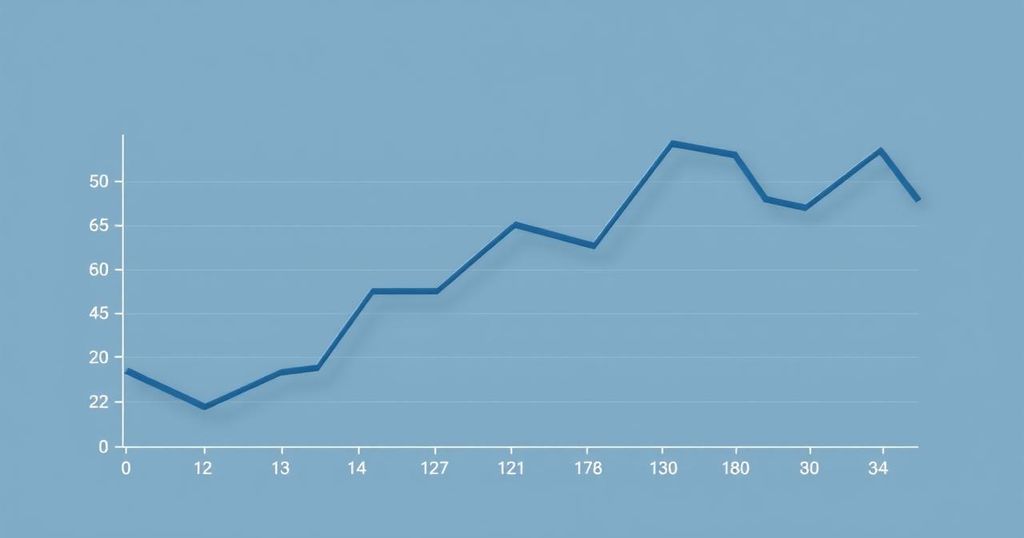

Tesla’s stock has been on a significant decline, erasing $700 billion in gains accumulated since the 2016 U.S. presidential election. As of Friday, Tesla’s shares dropped by 4.6% during the morning trading session, before regaining some ground in the afternoon. Overall, the stock has decreased over 28% in the past month and nearly 32% since the beginning of the year.

Following Donald Trump’s victory on November 5, 2016, Tesla thrived, bolstered by optimistic expectations concerning CEO Elon Musk’s relationship with the President. However, these initial expectations have faded, overshadowed by emerging issues with the company’s primary business of automotive sales. It was recently reported that Tesla experienced its first quarterly sales decline in a decade, further exacerbating investor concerns about its competitiveness in vital markets like Europe and China.

Investor anxiety has been intensified by Musk’s heightened involvement in political matters, potentially detracting from his leadership role. Adam Sarhan, founder of 50 Park Investments, remarked that the anticipated advantages of Musk’s political engagement have not materialized as expected, leading investors to reassess their positions.

The broader economic climate has also played a role in Tesla’s challenges, with reduced speculation contributing to a downturn in stock prices. The S&P 500 has decreased by more than 7% since its peak, while the Nasdaq 100 has entered a correction phase. Following these market shifts, Bank of America analyst John Murphy revised his price target for Tesla downwards from $490 to $380, citing sluggish car sales and the lack of updates on significant initiatives.

Despite the recent dip, technical analysts have noted that Tesla’s stock has entered an “oversold” zone, indicating the potential for a short-term recovery. Improved sales reports or updates regarding Tesla’s robotaxi program might serve as catalysts for such a rebound, especially in light of a broader resurgence in high-risk equities.

Nonetheless, significant concerns linger regarding Tesla’s valuation, as its forward price-to-earnings ratio remains significantly high at 88, compared to the S&P 500’s ratio of 21. Matt Maley from Miller Tabak + Co. has pointed out that the elevated valuation metrics pose challenges for future growth prospects.

In summary, Tesla’s stock has seen a dramatic decline, resulting in a substantial loss of market value since Trump’s election. The company’s initial post-election performance has been undermined by declining sales, market competition, and investor concerns regarding Musk’s focus. While there might be short-term recovery prospects, significant hurdles remain, particularly related to Tesla’s valuation metrics. Investors are now faced with deciding whether the stock’s current state signifies a bargain or a signal of ongoing challenges ahead.

Original Source: nypost.com